Switching to electronic payments is one of the simplest ways for a small business or organization to take advantage of the benefits of cloud accounting.

Collecting, preparing, approving, and completing payments to vendors can be a time-intensive process, involving multiple people in a team. But with some work flow planning and a bit of set-up, you can reduce the amount of time and money you spend preparing and tracking vendor payments. Electronic payment platforms such as Payment Evolution and Plooto create an excellent payment work flow and “paper-trail” that bolsters accountability and efficiency.

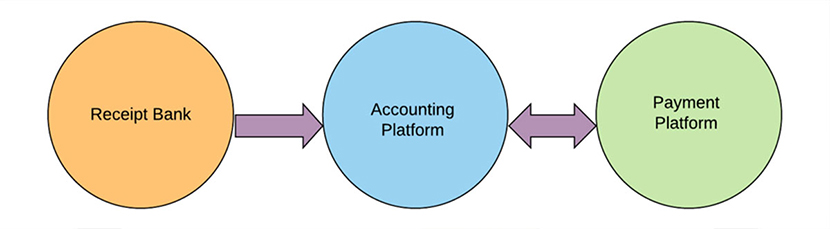

The major feature of integrated electronic payments is the communication between the accounting platform and the payments platform.

This means that information about outstanding payables is “pushed” from the accounting platform to the payment platform. Once payment is completed, that payment information is pushed back to the accounting program and the item is marked as paid. No writing cheques, no making note of the etransfer information, no re-entering into an EFT platform.

Here’s one example of how we use these tools with our clients:

- “Super Client”, submits their vendor bills and invoices to Receipt Bank.

- Once a week, the bookkeeper codes and pushes the payables to Xero and sends a message to “Super Client” letting them know that their payments are in Xero and ready for approval.

- Super Client will mark due dates in Xero on those payments to be paid that week.

- Because Xero and Plooto are integrated, the invoices and bills that have been entered and approved in Xero now appear in Plooto.

- The bookkeeper then goes into Plooto and completes payment. If the bank account requires two approvers on payments, then an approval email will be sent to both individuals requesting their approval, and funds will only be released upon their approval. The number or signatories can vary from bank account to bank account with lots of customization available.

Even without considering the time required to either write a cheque, send an etransfer or complete an EFT, the cost of completing a domestic payment is cheaper than most other methods of payment (usually $.85 to $1.00 per payment)

So what do you need to consider when looking at electronic payment platforms for your business or organization?

The answers to the following questions will help you identify which platform will work best for you.

- Approval – Do you require approval of payments by one or more individuals in your organization? Then make sure that the platform has an approval process. For organizations that need to prepare audited financial statements, these controls can be a huge benefit.

- Types of Vendors – Do you work with a list of regular vendors? Or are you working with a constantly changing roster? This will affect if and how you collect bank information from vendors and which platform will work best for you

- Location of Vendors – Different platforms are able to complete payments to different countries. If you know, for example, that you will be making regular payments to Papua New Guinea, you will want to make sure that your platform will support that type of transaction.

- Additional Payment – Do you want to be able to pay tax payments, utility bills, credit cards etc? If so, make sure that you set up a solution that will allow for paying both individual vendors as well as institutions.

- Accounts Receivable – Do you need to find a solution that will allow you to receive payments from customers as well as complete payments? Ensure that your platform can do both!

If you would like to explore more how electronic payments could improve your accounting workflow, reach out to us at Star Company. We’d be happy to help you find the solution that will make your life simpler!

Leave a Reply